ABN Amro

Mobile & Internet banking (app & web)

ABN Amro’s digital services seamlessly integrate with the bank’s financial products, catering to the needs of a diverse range of customers. I had the opportunity to contribute to the development of various digital services, from web to app, as well as creating new propositions.

As a UX designer and Service designer, I worked within agile and Kanban environments, applying these methodologies to ensure efficient collaboration and delivery. The customer and their needs were always at the core of every project. Ease of use, efficiency, and security played a key role in shaping these digital solutions.

What did I do

At ABN Amro, I contributed to various teams and worked on multiple products. I developed concepts that served as input for agile development teams, worked on the Mobile Banking App, and helped design new propositions for Internet Banking.

ABN Amro places a strong emphasis on delivering high usability for its customers while ensuring maximum security. As a result, research and legal considerations played a significant role in all my projects. These elements were integral to shaping user-centric and compliant solutions across the board.

01

App design

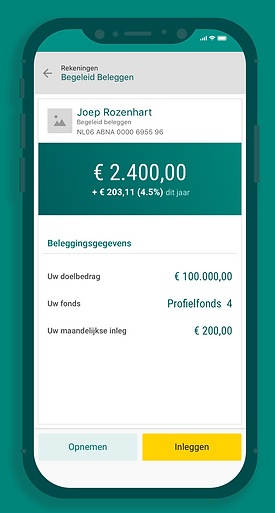

During my time at ABN Amro, I worked as part of one of the Scrum teams for the mobile banking app. This team was responsible for features such as payment flows, insights into investment products, and mortgage functionalities.

As a UX- and visual designer within the team, I designed user flows for the investment features and tested these flows in the usability lab with real customers. I also created illustrations to enhance the investment product, ensuring a more engaging and user-friendly experience. Additionally, I participated in various design sprints and research and created initiatives to optimize and modernize the existing payment flow.

02

Research

In addition to working with the app team, I was also part of another team tasked with developing a new financial proposition. This innovative service aimed to provide ABN Amro customers with greater insight into their financial situation.

Since the service was completely new, I conducted extensive user research to lay the foundation for its development. The insights from this research became the basis for the product's design and functionality. Techniques I applied included user interviews, creative workshops, and a design sprint.

03

Service design

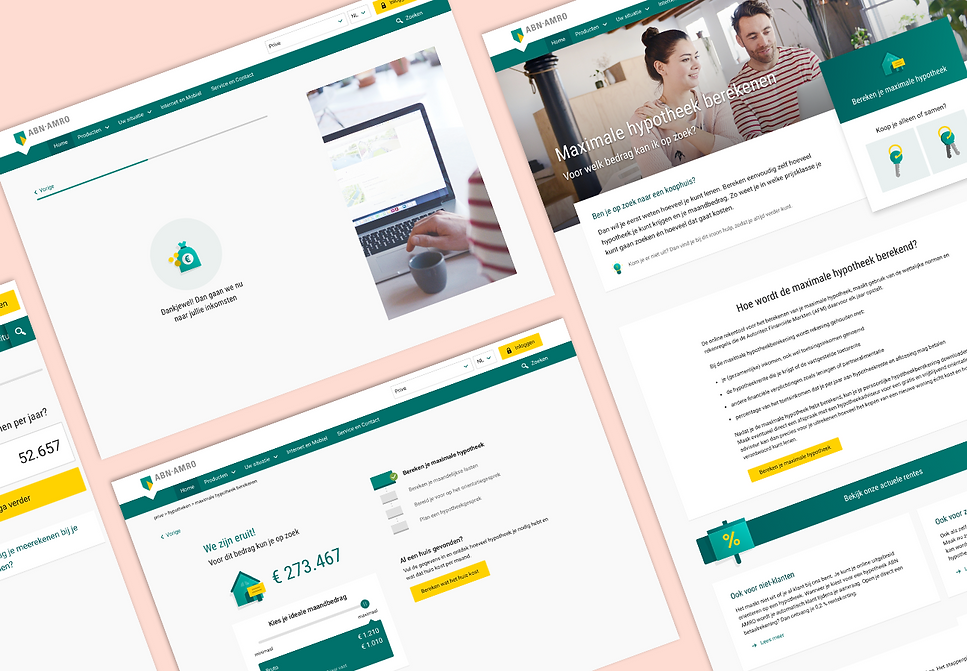

In addition to working with the app team, I was also part of another team tasked with developing a new financial proposition. This innovative service aimed to provide ABN Amro customers with greater insight into their financial situation.

As the starting point for this new product, I focused on developing the service itself. A key aspect of the product involved enabling customers to upload data from various government agencies. To support this, I created detailed customer journeys.

Additionally, it was crucial to gain a deeper understanding of the financial situations of different target groups. To achieve this, we developed personas that represented various user types. These elements—customer journeys, personas, and research insights—formed the foundation for the design and development of the new service.

04

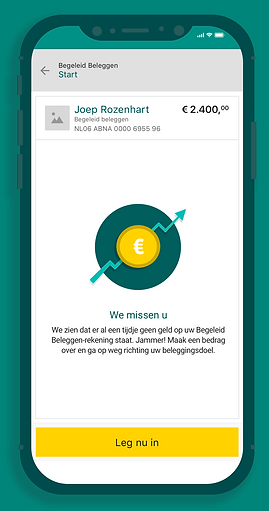

New proposition

As a UX designer, I took the lead in designing the product Financial Profile. To kickstart the process, I developed a tool on the open domain that allowed visitors to gain initial insights into their financial situation. Customers could then log in to their online banking environment to further enhance their profiles by adding additional data.

Using simple and intuitive data visualizations, the tool provided customers with a clear overview of their financial status. Furthermore, it offered personalized suggestions and options to help them improve their financial situation where needed.

05

Instruction video

To assist ABN Amro customers in setting up and uploading their financial profile, I created a simple instructional video. This video provided clear guidance on how to upload data and navigate the tool, making the process as straightforward as possible.